Was incorporated in the year 2007. Ami Organics IPO review May apply AOL is manufacturing speciality chemicals and critical APIs.

Ami Organics Ami is the latest in a line of chemical companies tapping the markets with an IPO.

Ami organics turnover. 341 cr in FY21 of which 88 from 450 pharma intermediates and 5 from specialty chemicals. AOL is a research and development RD. Amoli Organics Private Limited is a Private incorporated on 19 September 1991.

Ami Organics Limited is dedicated to optimize the utilization of healthcare resources and effectively meet your expectations of comprehensive portfolio of varied products custom synthesis or contract manufacturing expertise in your prospective projects. In the latest quarter company has reported Gross Sales of Rs. Ami Organics Limited is a Public incorporated on 12 June 2007.

Its authorized share capital is Rs. Ami Organics IPO review May apply AOL is manufacturing speciality chemicals and critical APIs. Limited Company LtdPvtLtd Annual Turnover.

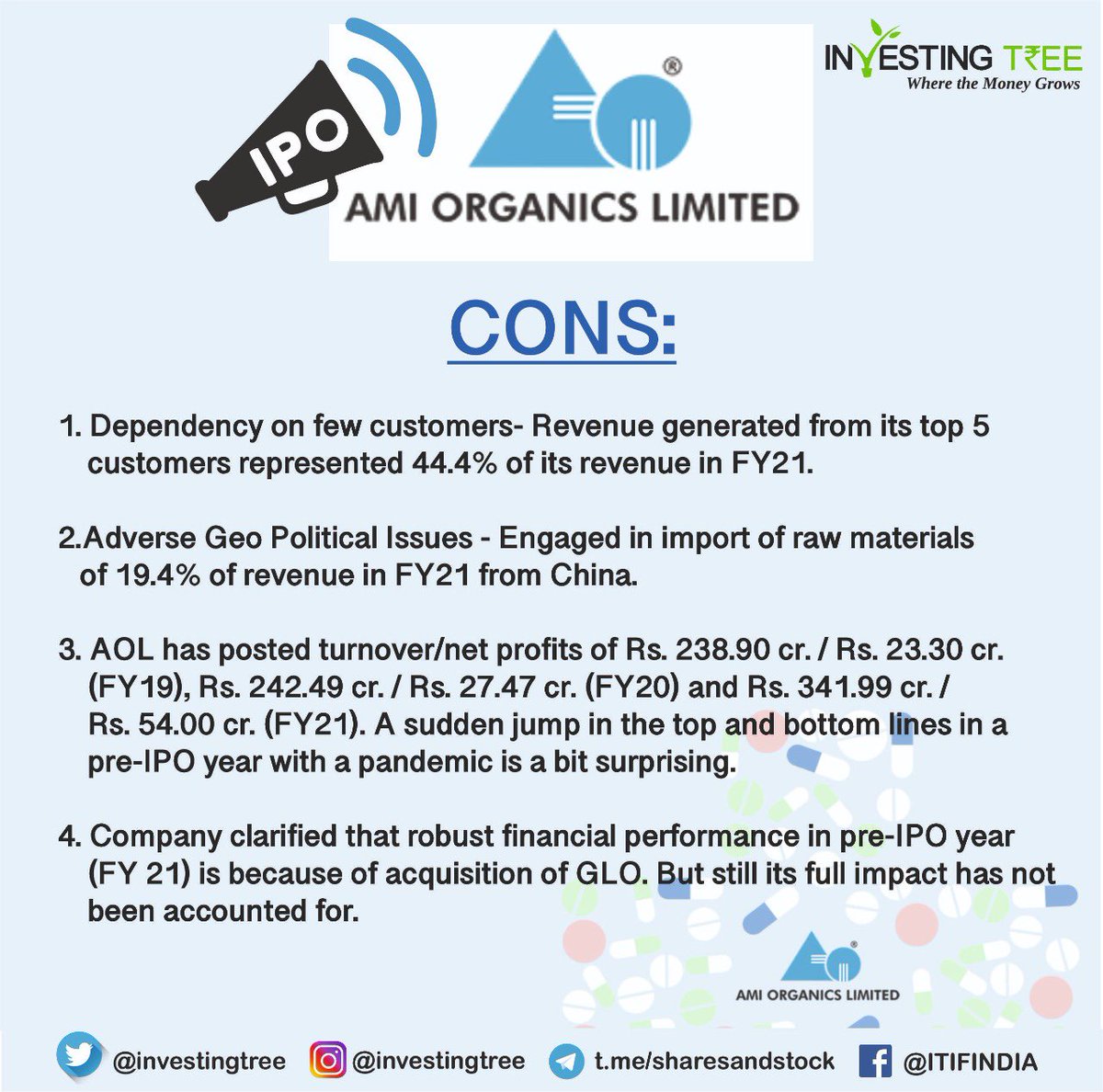

The IPO will be a mix of a fresh issue and an offer for sale OFS. Ami Organics in consultation with leading book managers has undertaken a pre-IPO placement of shares valued at Rs 100 crore. Robust performance in pre-IPO year raises concern.

91 75730 15366 72279 77744 E-Mail. Legal Status of Firm. It is classified as Non-govt company and is registered at Registrar of Companies Ahmedabad.

Ami Organics Ltd. Its todays share price is 0. In the latest quarter company has reported Gross Sales of Rs.

Gujarat Based Specialty Chemicals Company. Of Shares in Lakhs 3279. One can check the allotment on the given below link with PAN number or.

4404 5 6 Plot No8206B GIDC Sachin Surat 394230. Ami organics turnover. In the latest quarter company has reported Gross Sales of.

100 - 500 Crore. The IPO which is already open includes an OFS portion of 370 crore and a. IPO allotment status would be available soon after the IPO closure date.

Gujarat - INDIA Tel. 500000000 and its paid up capital is Rs. Ami Organics Ltd 31- August-21 Subscribe Company Description Issue Details Issue Details Issue Size Value in Rs.

125000000 and its paid up capital is Rs. Its todays share price is 0. Based on financial parameters IPO is fully priced.

The companys management includes Virendra Nath Mishra Ekta Kumari Nareshkumar Patel Girikrishna. Based on financial parameters IPO is fully priced. It is inolved in.

The company in its draft red herring prospectus had. The size of the new number has been reduced by Rs 100 crore. AOL is a research and development RD.

The recent situation proceeds might be utilised to. 3 key pharma intermediates accounting for 50 of revenue enjoy global market share between 70-90. The net proceeds from the fresh issue will be used by the company to repay certain debts and working capital.

It is classified as Non-govt company and is registered at Registrar of Companies Ahmedabad. Its current market capitalisation stands at Rs 0 Cr. The IPO which is already open consists of an OFS portion of 370 crore and a recent situation of 200 crore.

Ami Organics Limited - Manufacturer of apixaban perindopril erbumine bortezomib in Surat Gujarat. Risk seekerscash surplus investors may consider the investment. Its authorized share capital is Rs.

Was incorporated in the year 2007. On 2460 MT installed capacity and 63 utilisation Ami Organics clocked revenue of Rs. Ami Organics Ami is the newest in a line of chemical corporations tapping the markets with an IPO.

Robust performance in pre-IPO year raises concern. Its current market capitalisation stands at Rs 0 Cr. Risk seekerscash surplus investors may consider the investment.

Usually the allotment comes within a week from the closing date which in this IPO yet to be announced. 340608 Cr and Total Income of Rs341938 Cr. Million Upper Band pharmaceutical intermediates Pharma Intermedi5696 Fresh Issue No.

Ami Organics Private Limited Surat Manufacturer Of Acotiamide Tablet And Apixaban Tablets

Ipo Note Ami Organics Ltd By Choice Broking

Welcome To Ami Organics Limited

China One Of The Top 4 Organic Markets Worldwide Organic Market Info

Ami Organics Ipo Dates Allotment Subscription Gmp Rhp

Ami Organics Ipo Dates Review Price Form Lot Size Allotment Details 2021 Hindisip Com

Ami Organics Ipo Summary In 10 Points All You Need To Know

Https Www Ambit Co Public Regulatory Ib Ami 20organics 20limited 20 20drhp Pdf

Ami Organics Ipo Dates Review Price Form Lot Size Allotment Details 2021 Hindisip Com

Ipo Note Ami Organics Ltd By Nirmal Bang

Kanchi Karpooram Ltd Buyback 2020 With Record And Payment Details History Ipo Watch List

Post a Comment

Post a Comment